Last updated: December 12, 2025

Written by Balotellio_Writer, Home Insurance & Money Basics Educator

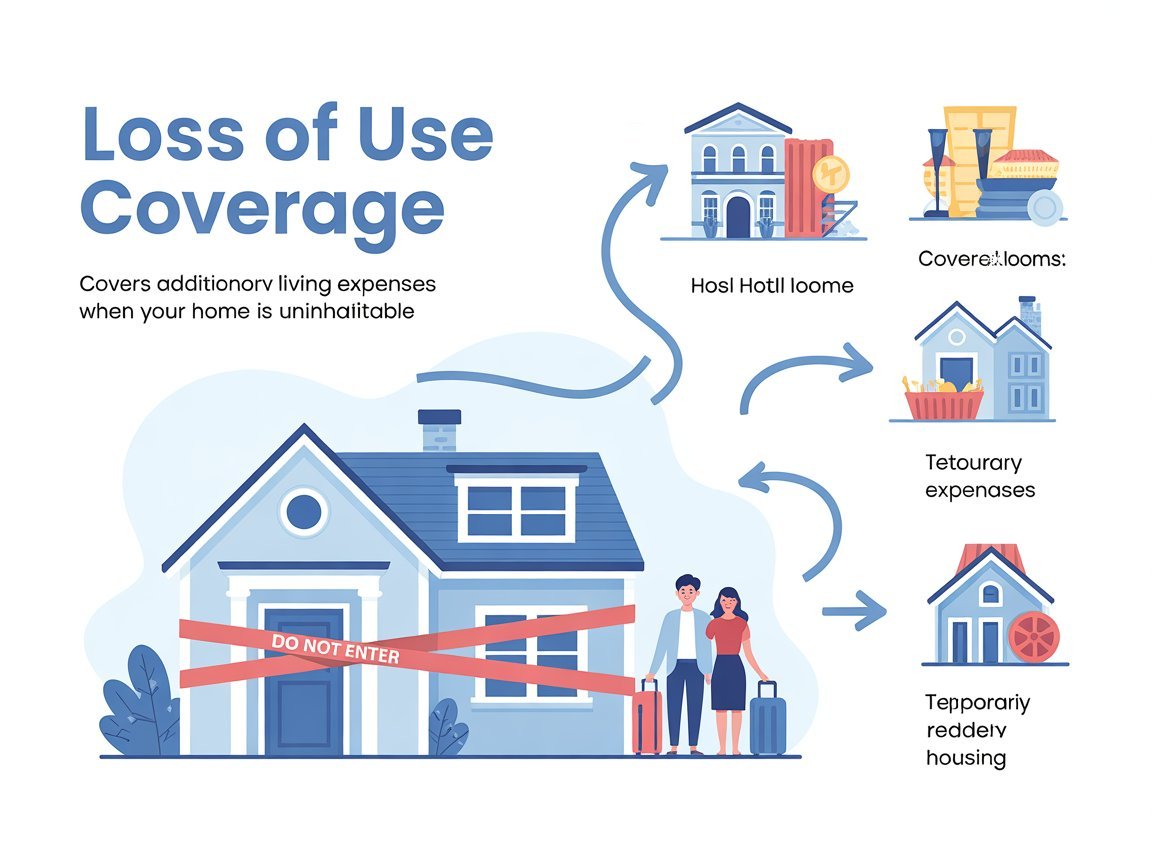

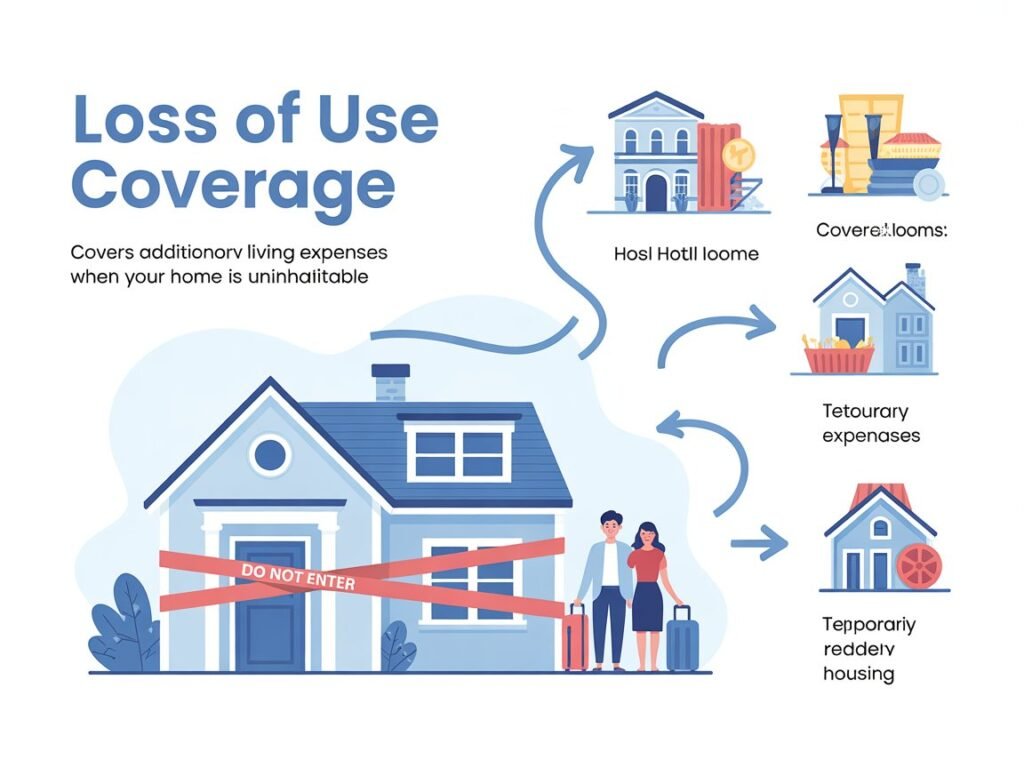

Imagine this: a kitchen fire or burst pipe makes your home unlivable. You can’t stay there, but the mortgage, rent, or property taxes don’t care. You still need somewhere to sleep, eat, shower, do laundry, maybe board the dog…and all of that costs money.

That’s where loss of use coverage comes in.

When you see people search for “loss of use coverage explained”, they’re really asking:

“If my home is being repaired after a covered loss, what will my insurance actually pay for, and for how long?”

Let’s break it down in clear, beginner-friendly language with real examples and numbers.

1. Loss of Use Coverage Explained in Plain English

In a standard homeowners or renters policy, Loss of Use is usually Coverage D. It’s also called:

- Additional Living Expenses (ALE)

- Loss of Use

- Sometimes Fair Rental Value (for landlords)

Regulators and insurance guides describe it like this:

- Loss of use coverage pays additional living expenses when a covered loss makes your home uninhabitable while it’s being repaired or rebuilt. NAIC+2Oregon Division of Financial Regulation+2

- It’s designed to cover the extra costs of living somewhere else, beyond what you would normally spend at home. NAIC+2IDOI+2

In short:

If a covered disaster forces you out of your home, loss of use coverage helps pay the extra costs of temporary life somewhere else.

2. What Does Loss of Use Actually Pay For?

Different insurers phrase it differently, but common examples are very consistent across NAIC, state insurance departments, and major insurers. Openly+4NAIC+4McGriff-Williams Insurance+4

Typical things loss of use coverage can help with (up to your policy limits):

- Temporary housing

- Hotel, motel, Airbnb, short-term rental, or apartment

- Increased food costs

- If you’re staying in a hotel or place without a full kitchen and eating out more than usual, it can cover the extra cost above your normal grocery/meal spending

- Utilities at the temporary place (if they’re in addition to your normal bills)

- Laundry expenses (laundromat, laundry service)

- Transportation

- Extra gas or public transit if you’re now farther from work or school

- Pet boarding if your temporary housing won’t take pets

- Storage fees if you need to store belongings during repairs

- Moving costs associated with moving to and from temporary housing

Some policies also include Fair Rental Value: if you rent out part or all of your home and it becomes uninhabitable due to a covered loss, loss of use can reimburse the lost rental income you would have received. III+1

The key phrase you’ll see in many official definitions is that ALE “pays expenses over and above your normal living costs” while your home is being repaired. IDOI+2United Policyholders+2

3. Real-Life Example: Hotel, Food, and Gas

Let’s say a fire in your kitchen (a covered peril) makes your home uninhabitable for 3 months while repairs are done.

Your normal monthly living expenses at home might look like:

- Mortgage: $1,600

- Utilities: $250

- Groceries & meals: $700

- Gas/transportation: $150

Now, with loss of use coverage:

- You stay in a hotel or short-term rental: $2,800/month

- Utilities at the rental: maybe included, or small extra bills

- You eat out more because you don’t have a normal kitchen: $1,100/month instead of $700

- Extra gas because your temporary place is farther from work: $220/month instead of $150

The extra costs over normal might be:

- Housing: $2,800 – (your normal $1,600 mortgage) = $1,200 extra

- Food: $1,100 – $700 = $400 extra

- Gas: $220 – $150 = $70 extra

So, roughly:

- Additional living expenses per month = $1,200 + $400 + $70 = $1,670

As long as the loss is covered and you’re within your time and dollar limits, loss of use coverage can reimburse that $1,670 per month, not the full $2,800 housing cost, because you’d be paying $1,600 for somewhere to live anyway.

That’s the heart of loss of use coverage explained:

Insurance pays the difference between your normal costs and your new, higher costs caused by being displaced.

4. When Does Loss of Use Coverage Kick In?

Loss of use doesn’t pay out just because you’re inconvenienced. Most guides and insurers agree it typically applies when: insurance.ca.gov+3NAIC+3kin.com+3

- There’s a covered loss

- Fire, windstorm, burst pipe, etc., that is covered under your policy

- Remember: things like flood and earthquake are usually excluded unless you have special policies

- Your home is uninhabitable

- It’s unsafe, missing critical systems (no heat, no safe power, major structural damage), or a government authority or adjuster says you can’t live there

- This is often based on building codes, health and safety, or explicit evacuation orders

- Civil authority orders you out (sometimes)

- Some policies cover loss of use when a civil authority prohibits you from living in your home due to damage from a covered peril nearby (for example, wildfire smoke or adjacent building fire that makes your area unsafe). kin.com+1

Loss of use coverage does not usually apply if:

- You choose to move out for convenience while minor repairs are done

- The issue is something not covered by your policy (e.g., routine maintenance problems, gradual wear and tear, many types of flood, or earthquakes without special coverage) Kiplinger+1

5. How Much Loss of Use Coverage Do You Get?

Loss of use coverage usually has limits, and they’re often defined in one of two ways:

- Percentage of your dwelling coverage

- A common setup is that loss of use is equal to 20–30% of your Coverage A (dwelling limit), depending on the company and policy. ClaimGuide.org+2III+2

- Example: If your dwelling coverage is $300,000 and loss of use is 30%, you may have about $90,000 total for additional living expenses and/or fair rental value.

- Time limit

- Some policies limit how long ALE will pay, such as 12 or 24 months, even if you haven’t exhausted the dollar limit, or vice versa. Bankrate+2Maine+2

Loss of use usually pays until the earliest of:

- Your home is repaired or rebuilt and is habitable again

- You permanently relocate to a new home

- You hit your policy limits (dollar or time)

There’s no “infinite hotel forever” option — it’s meant to get you through the repair/rebuild period, not replace a home long term.

6. Loss of Use vs Your Normal Bills

This is a big point many people miss.

Loss of use usually covers extra costs, not all costs. So typically:

- It does not replace your mortgage or rent on the damaged home. You’re still on the hook for that. NAIC+2Oregon Division of Financial Regulation+2

- It does not pay your normal utilities, normal food budget, or typical commute costs.

- It does pay the additional costs above your normal lifestyle that exist only because you can’t live at home. millerpublicadjusters.com+2IDOI+2

That’s why, in our earlier example, the insurer calculates:

Temporary rent – normal housing cost = extra housing expense

and reimburses the extra portion.

This is also why it’s so important to keep receipts and sometimes even track your “before vs after” spending. Many state resources and insurance departments recommend keeping detailed receipts and records to prove your additional living expenses. insurance.ca.gov+1

7. What About Renters and Landlords?

Loss of use isn’t just for homeowners.

Renters

If you have a renters insurance policy, it often includes loss of use / ALE as well.

- If a covered loss makes your rental uninhabitable, ALE can help pay for temporary housing and extra living expenses, similar to homeowners policies. Lemonade+2Financial Health Network+2

- Your landlord’s insurance generally covers the building, not your hotel, food, or personal expenses. That’s your renters policy’s job if you have one.

Landlords / Rental Property Owners

For homeowners who rent out their property:

- Loss of use may include Fair Rental Value, which can reimburse you for lost rental income while the unit is uninhabitable due to a covered loss. III+2Openly+2

It’s important to check whether your policy is:

- A standard homeowners policy with some rental endorsement

- A landlord/dwelling policy with specific loss of rent provisions

8. Common Mistakes and Surprises with Loss of Use

Here are some things that often catch people off guard.

8.1 Not Realizing There’s a Dollar or Time Cap

After big disasters (wildfires, major storms), rebuilding can take much longer than anyone expects. Government and consumer groups often warn that people hit their ALE limits before repairs are finished, especially if local building costs spike or there are contractor shortages. Oregon Division of Financial Regulation+2Maine+2

If your loss of use limit is too low, you may run out of coverage months before you can move home.

8.2 Assuming “Uncomfortable” Means “Uninhabitable”

Insurers and adjusters rely on policy language and sometimes building codes.

Examples where loss of use may not kick in:

- The work is loud and annoying, but the home is still technically safe to live in

- Cosmetic repairs where basic functions (water, heat, electricity) still work

- Voluntary relocation to stay with family even if the adjuster says the home is habitable

8.3 Forgetting to Document Everything

Many state insurance departments advise that to get reimbursed for ALE, you often need:

- Receipts for hotels, extra meals, laundry, storage, pet boarding, etc.

- Sometimes a written explanation of what’s “extra” versus normal expenses

No receipts = much harder to get paid back. insurance.ca.gov+1

8.4 Thinking Flood/Quake Displacement Is Automatically Covered

Standard homeowners policies usually:

- Don’t cover flood, and

- Often don’t cover earthquake, unless you’ve bought those separately

So if a flood (not just a burst pipe) makes your home uninhabitable, your regular loss of use might not apply unless you have flood insurance that includes ALE. Kiplinger+1

9. How to Check and Adjust Your Loss of Use Coverage

If you’re searching “loss of use coverage explained,” you’re already ahead of most people. Here’s how to turn that into action.

- Find Coverage D / Loss of Use on your declarations page

- Look for “Loss of Use,” “Additional Living Expense,” or “Coverage D” and note the dollar amount or percentage. Oregon Division of Financial Regulation+2Maine+2

- Ask your agent or insurer specific questions

- “Is my loss of use coverage a percentage of my dwelling limit? What is it exactly?”

- “Is there a time limit (12 months, 24 months)?”

- “Does it cover Fair Rental Value if I’m renting out part of my property?”

- “What counts as ‘uninhabitable’ under this policy?”

- Think through a realistic scenario

- If your home was out of commission for 6–12 months, ask:

- Could I realistically rent somewhere in my area with this limit?

- Would I be okay if my ALE ran out before repairs finished?

- If your home was out of commission for 6–12 months, ask:

- Consider increasing coverage if needed

- Some insurers allow you to adjust ALE limits above the default percentage or choose higher tiers of coverage, usually with a modest premium increase. ClaimGuide.org+1

- Set a receipts habit

- In any emergency or displacement, make it a reflex to save every receipt and keep a simple log of extra expenses. It will make the claims process smoother and help you get the full amount you’re owed. insurance.ca.gov+1

10. Quick FAQ: Loss of Use Coverage Explained

Q1: Does loss of use coverage pay my mortgage or normal rent?

Usually no. It pays the extra costs above your normal housing expenses. You’re still responsible for your mortgage or rent on the damaged home. NAIC+2Oregon Division of Financial Regulation+2

Q2: Is loss of use coverage the same as additional living expense coverage?

Yes, in most homeowners and renters policies, loss of use is the section that includes additional living expenses (ALE) and sometimes fair rental value. They’re closely related terms and often used interchangeably. III+3NAIC+3McGriff-Williams Insurance+3

Q3: Does loss of use coverage apply if I can still technically live in the home?

Not usually. It generally applies only when the home is uninhabitable (unsafe or not reasonably livable) due to a covered loss, or when a civil authority orders you out. Maine+3kin.com+3insurance.ca.gov+3

Q4: Is there a deductible for loss of use?

Often, loss of use doesn’t have a separate deductible; the property damage deductible generally applies to the overall claim. But the exact structure can vary by policy, so it’s worth asking your insurer or checking your policy language. NAIC+1

Q5: Does renters insurance include loss of use coverage?

Most standard renters policies do include some level of loss of use/ALE coverage, but you should check your declarations page to see the limit and what’s included. Consumer Financial Protection Bureau+2Lemonade+2

Final Thoughts

If your home becomes unlivable, loss of use coverage can be the difference between financial chaos and “this is stressful, but we’re going to be okay.”

Remember the core idea behind “loss of use coverage explained”:

It doesn’t replace your entire life — it covers the extra cost of living somewhere else while your insured home is being repaired, up to policy limits.

A few small moves now — reading your declarations page, asking a couple of specific questions, and checking your limits — can save you a lot of panic later if something big goes wrong.