Last updated: December 02, 2025

Written by Balotellio_Writer,Home Insurance & Property Basics Educator

You probably bought homeowners insurance to protect “your house.”

But your fence, shed, detached garage, and even some solar panels aren’t actually insured under the main house section.

They usually fall under something called “other structures coverage” (Coverage B).

If you’ve ever asked yourself:

“Is my fence or shed covered?”

“Do my ground-mounted solar panels count as part of the house?”

“What does ‘10% for other structures’ even mean?”

…this article is for you.

Let’s walk through other structures coverage explained in plain English, with real examples and numbers.

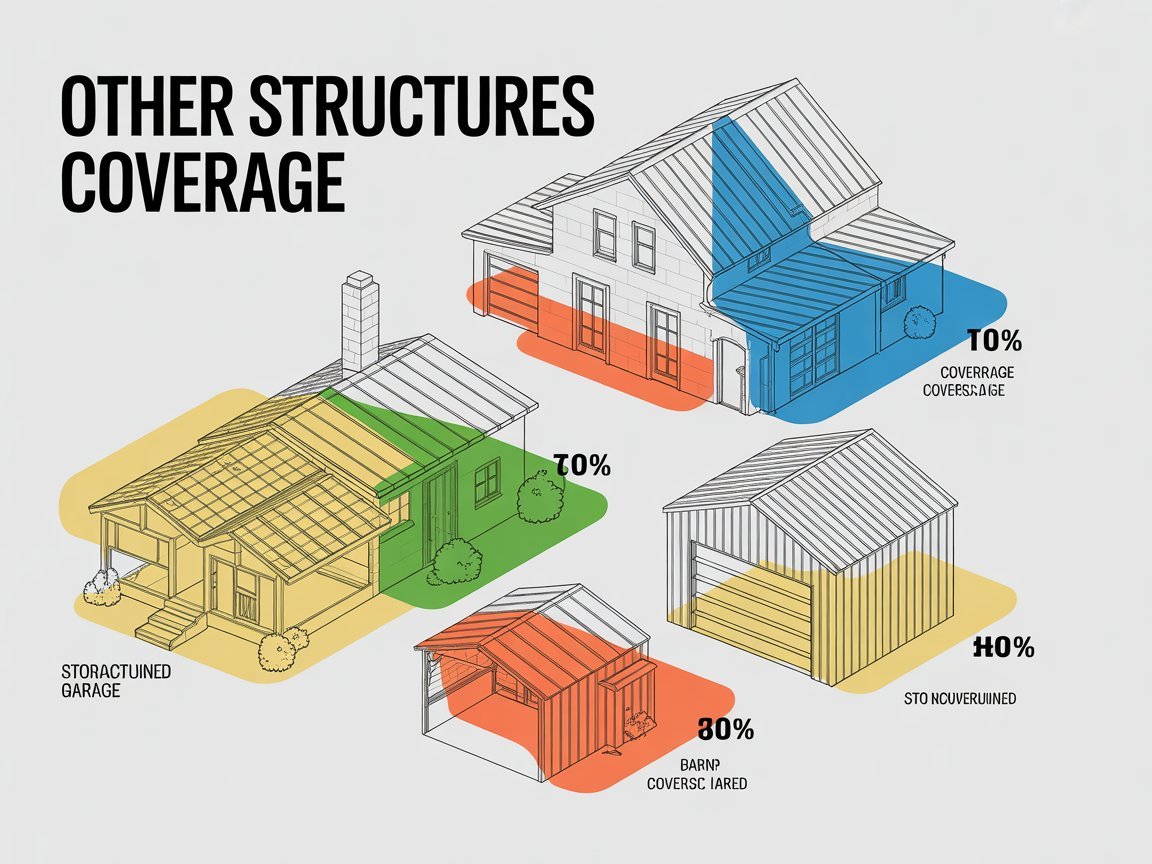

1. What Is Other Structures Coverage? (Coverage B in Your Policy)

In a standard homeowners policy (like an HO-3), you’ll see several property coverages:

- Coverage A – Dwelling (the house itself)

- Coverage B – Other Structures

- Coverage C – Personal Property

- Coverage D – Loss of Use

Regulators and consumer guides explain other structures coverage as the part of your policy that pays for damage to structures on your property that are not attached to your house. Consumer Financial Protection Bureau+2Citi Card Benefits+2

Examples from consumer sites and insurers include:

- Detached garages

- Fences

- Sheds and small outbuildings

- Gazebos and pergolas

- Driveways, walkways, some retaining walls

- Docks or small boat houses

- Guesthouses or small cabins equifax.com+3Merchant Savvy+3equifax.com+3

If it’s on your property but not physically attached to the house, it probably lives under other structures coverage.

Think of Coverage B as “everything on your lot that isn’t literally part of the main house walls or an attached garage.”

2. How Much Other Structures Coverage Do You Usually Get?

Most standard homeowners policies automatically include other structures coverage as a percentage of your dwelling limit.

Common ranges:

- Many insurers default to about 10% of Coverage A (your dwelling limit) VantageScore+4Experian+4Investopedia+4

- Some policies go up to 10–20% of the dwelling limit, depending on the company and product McAfee+1

Example:

- Your home (Coverage A) is insured for $400,000

- Your other structures coverage is 10% of that

- Coverage B limit = $40,000

That $40,000 is the maximum your policy will pay (before deductible) for all detached structures combined in a single covered loss.

The NAIC’s consumer home insurance guide notes that limits for other structures, personal property and loss of use are typically expressed as percentages of your dwelling limit, which is why this 10% setup is so common. Investopedia+1

3. What Counts as “Other Structures” on Your Property?

Let’s make this concrete. Common items often covered under other structures coverage include:

- Detached garage (even if finished as a workshop or game room)

- Fences around your yard or pool

- Storage shed or garden shed

- Gazebo, pergola, pavilion

- Detached carport

- Driveway, detached patio, some walkways or retaining walls

- Greenhouse, barn, small outbuildings

- Certain types of pools or pool houses, depending on the policy

Consumer guides and insurers list these regularly as typical “other structures.” Expree Credit Union+3Citi Card Benefits+3Wikipedia+3

A few key ideas:

- If a garage is attached to the home, it’s usually part of Coverage A (dwelling).

- If it’s detached, it flips over into Coverage B (other structures coverage) instead. Citi Card Benefits+1

4. Where Do Solar Panels Fit? Roof vs Ground vs Shed

Solar is where things get interesting.

Most up-to-date solar and insurance guides say:

- Roof-mounted solar panels are usually treated as part of the dwelling (Coverage A). They’re physically attached and become part of the building. files.consumerfinance.gov+1

- Ground-mounted solar arrays or panels mounted on a detached garage, shed, or carport are often treated as part of other structures coverage instead. MyCreditUnion.gov+1

That means:

- If your panels are on the roof of your house, damage might eat into your dwelling limit.

- If your panels are on a detached structure or on the ground, damage often eats into your other structures coverage limit, which might only be 10% of dwelling coverage.

For a typical solar setup costing tens of thousands of dollars, that matters a lot. If your Coverage B limit is small and your solar installation is large (plus the value of the shed, fence, etc.), you could easily be underinsured. FHI 360+1

If you have solar on a shed, garage, or ground mount and you care about it, treat “other structures coverage” like a serious number, not a throwaway.

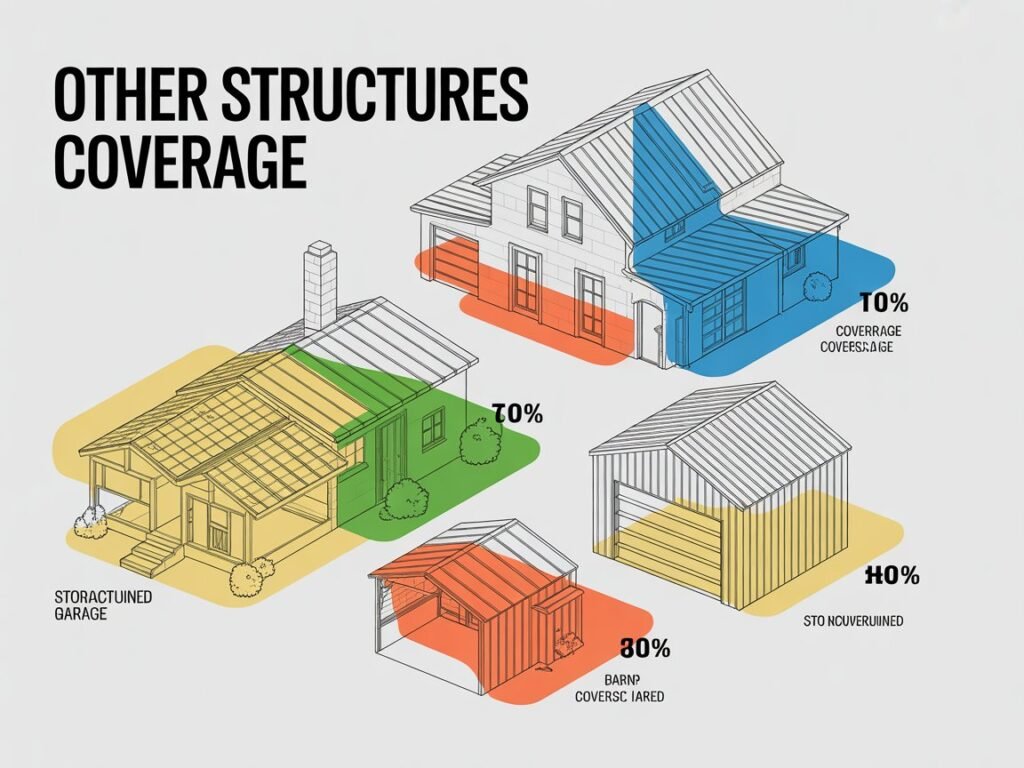

5. Real-Life Example: Fence + Shed + Solar vs Your Limit

Say your policy looks like this:

- Dwelling limit (Coverage A): $500,000

- Other structures coverage (10%): $50,000

On your property you have:

- Detached garage: estimated replacement cost $25,000

- Nice vinyl privacy fence: $15,000 to replace

- Solar array mounted on the detached garage roof: $20,000

Total potential replacement cost if a huge windstorm wrecked everything at once:

- $25,000 + $15,000 + $20,000 = $60,000

But your other structures coverage limit is $50,000.

So even before you think about debris removal or code upgrades, you’re $10,000 short, not counting your deductible.

That’s how people end up saying, “I thought my fence and shed were covered,” only to find that yes, they’re covered…just not for enough.

Many insurers note that while the default limit is often 10% of the dwelling, you can increase Coverage B if you have high-value detached structures or solar equipment. Jenius Bank+3Bridgeforce+3VantageScore+3

6. What Perils Are Typically Covered?

Under a standard HO-3 policy form, the house and other structures are usually covered on an “open perils” basis:

- That means they’re covered for any cause of loss unless it’s specifically excluded (like flood, earthquake, wear and tear, etc.). Consumer Financial Protection Bureau+2Experian+2

Common covered events for other structures coverage include things like:

- Fire and smoke

- Windstorm and hail (some high-risk areas have special rules/deductibles)

- Lightning, explosion

- Vandalism, certain impact damage (like a vehicle hitting your fence)

- Weight of ice or snow (depending on policy language)

But standard exclusions still apply:

- Flood and many types of surface water

- Earthquake/earth movement (separate coverage often needed)

- Normal wear and tear, rot, deterioration

- Neglect or intentional damage

Always check the policy’s exclusion list. The fact that a structure is under Coverage B doesn’t magically include perils that aren’t covered for the dwelling itself. myFICO+2Consumer Financial Protection Bureau+2

7. Important Exclusions & Gotchas for Other Structures

The fine print around business use and rentals can really change what’s covered.

The standard HO-3 sample form includes exclusions under Coverage B for: FICO+3Consumer Financial Protection Bureau+3Capital One+3

- Other structures rented or held for rental to someone who isn’t a tenant of the dwelling (unless used only as a private garage)

- Other structures used for business (like a detached workshop where you do paid auto repair or run a small manufacturing operation)

- Other structures used to store business property, except in limited circumstances

Translation:

- If you convert your detached garage into a commercial woodshop, your standard other structures coverage may no longer apply to that building.

- If you rent the detached cottage as a separate unit without the right endorsements, it may not be covered the way you think.

Specialist guides remind homeowners that if you’re using detached structures for business or rental purposes, you often need separate or extra coverage (like a landlord policy, business policy, or specific endorsements). Equifax+3Consumer Financial Protection Bureau+3The Money Charity+3

Other common quirks:

- Land itself isn’t covered (only the structure on it). Consumer Financial Protection Bureau+1

- If you’ve heavily upgraded a shed or outbuilding (heat, plumbing, fancy finishes), its replacement cost may be far beyond what you assume, which can quickly bust through a 10% limit.

8. How to Check Your Own Other Structures Coverage

If you want “other structures coverage explained” for your policy, here’s the quick checklist:

- Find Coverage B on your declarations page

- Look for a line like “Coverage B – Other Structures” with a dollar amount.

- Confirm whether it’s 10%, 20%, or a custom number based on your dwelling limit. Investopedia+2TransUnion+2

- List everything on your property that counts as an “other structure”

- Fences

- Sheds, detached garages, pool houses

- Gazebos, pergolas, retaining walls

- Ground-mounted or detached-structure solar arrays

- Roughly estimate replacement cost for each

- What would it cost today to rebuild that garage or fence from scratch?

- Don’t forget the cost of solar panels plus any mounting/installation hardware.

- Compare your total replacement cost vs your Coverage B limit

- If the total value of all detached structures (plus solar) is way higher than your limit, you’re probably underinsured.

- Talk to your agent or insurer about raising limits or adding endorsements

Questions to ask:- “Is my other structures coverage strictly 10% of dwelling, or can I increase it?”

- “How are my solar panels classified—dwelling or other structures?”

- “Are any detached buildings excluded because of business or rental use?”

Many insurers allow you to increase Coverage B for an extra premium, especially when you have high-value structures like large shops, guesthouses, or solar installations. Bridgeforce+2VantageScore+2

9. Quick FAQ: Other Structures Coverage

Q1: Is other structures coverage optional?

Most standard homeowners policies automatically include some level of other structures coverage, typically around 10% of your dwelling limit. You can often adjust it, but you’d have to specifically exclude it or use a non-standard policy to have none at all. Wikipedia+3Citi Card Benefits+3Bridgeforce+3

Q2: Does other structures coverage include the stuff inside my shed or garage?

Usually no—the building itself is Coverage B, but the items inside (tools, bikes, lawn equipment) are usually covered as personal property (Coverage C), subject to that coverage’s limits and perils. Consumer Financial Protection Bureau+2Consumer Financial Protection Bureau+2

Q3: Are in-ground pools covered as other structures or dwelling?

It depends on the insurer. Some treat in-ground pools as other structures; others treat them as part of the dwelling, especially if they’re attached with a deck or enclosure. Above-ground portable pools can even be treated as personal property. Always check how your policy classifies pools. Merchant Savvy+1

Q4: Do ground-mounted solar panels always fall under other structures coverage?

Not always, but many insurers treat solar panels on ground mounts or detached structures as part of other structures coverage, while roof-mounted panels are part of the dwelling. Because systems are expensive, it’s crucial to confirm classification and limits with your insurer. MyCreditUnion.gov+1

Q5: Does other structures coverage pay replacement cost or actual cash value?

In many HO-3 policies, the home and other structures are insured at replacement cost, while personal property is often ACV by default unless you upgrade it. But this can vary by insurer and policy, so check the “loss settlement” section or ask your agent directly. Experian+2Consumer Financial Protection Bureau+2

Final Thoughts

At a glance, other structures coverage looks like a small throw-in line under Coverage B. In reality, it’s what stands between you and a very expensive bill if a storm or fire takes out your fence, shed, detached garage, or solar array.

The big ideas to remember:

- Other structures coverage = detached stuff on your property

- Defaults are often 10% of your dwelling limit, but that may not be enough

- Solar panels on detached structures or ground mounts can eat up that limit quickly

- Business or rental use can change what’s covered and what isn’t

Spend ten minutes looking at your declarations page and asking a few pointed questions, and you’ll know whether Coverage B is quietly doing its job—or quietly leaving you exposed.