Last updated: December 12, 2025

Written by Balotellio_Writer, Home Insurance & Money Basics Educator

You buy home insurance thinking,

“If something bad happens, the insurance company will just pay to fix it… right?”

Then a storm hits, part of your roof is gone, and the adjuster says something like:

- “We settle on actual cash value.”

or - “You have replacement cost on the dwelling.”

And suddenly it feels like they’re speaking another language.

The phrase “actual cash value vs replacement cost home insurance” is really about one big question:

When your home or stuff is damaged, does your policy pay what it costs to replace it today, or does it subtract for age and wear-and-tear?

Let’s break that down in normal human language, with real numbers, so you can tell what you actually bought — and whether you need to change it.

TL;DR box (Featured Snippet bait)

Actual cash value (ACV) = replacement cost minus depreciation (age/wear).

Replacement cost (RCV) = pays the cost to repair/replace today with like kind/quality (no depreciation), often via ACV first + “recoverable depreciation” later after receipts.

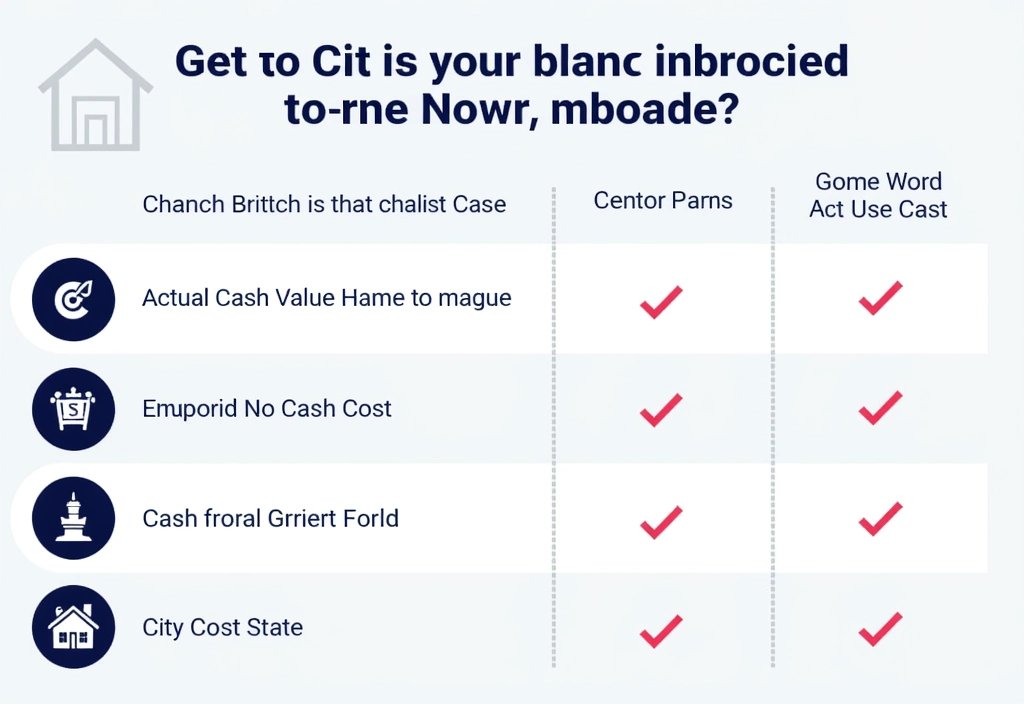

| Feature | Actual Cash Value (ACV) | Replacement Cost (RCV) |

|---|---|---|

| Depreciation deducted? | Yes | No (usually recoverable) |

| Typical payout timing | One payout | Often 2-step (ACV then holdback) |

| Premium | Lower | Higher |

| Best for | People who can cover the gap | People who want “restore it now” protection |

1. Actual Cash Value vs Replacement Cost Home Insurance: The Core Difference

Replacement cost (RC/RCV)

Replacement cost coverage is designed to pay what it costs today to repair or replace damaged property with materials of like kind and quality, without subtracting for depreciation.

Commonly applied to:

- Dwelling/structure (your home itself)

- Personal property only if you add a replacement cost endorsement (many policies default to ACV for contents)

Actual cash value (ACV)

Actual cash value usually means:

ACV = Replacement Cost − Depreciation

Depreciation is typically based on:

- age

- condition

- expected useful life

- sometimes obsolescence

Plain English:

- Replacement cost = “new for old.”

- Actual cash value = “what your old stuff was worth today.”

2) Where to find this in your policy (what to look for)

Check your declarations page and the loss settlement section.

You may see language like:

- “Losses to the dwelling are settled at replacement cost.”

- “Personal property is settled at actual cash value unless endorsed otherwise.”

- “Roof surfaces are settled at actual cash value.” (This is more common than people realize.)

If it’s unclear, ask your agent one direct question:

“Is my dwelling ACV or replacement cost — and what about my roof and personal property?”

(Those can be different.)

3. Roof claim example (real numbers, no fluff)

Imagine:

- Cost to replace roof today: $20,000

- Roof age: 15 years

- Expected roof life: 30 years

- Deductible: $1,500

Scenario A: Actual Cash Value roof coverage

If your roof is settled on ACV:

- Replacement cost: $20,000

- Depreciation: 50% (15 of 30 years) = $10,000

- ACV settlement: $20,000 − $10,000 = $10,000

- Apply deductible: $10,000 − $1,500 = $8,500 payout

Your out-of-pocket:

- Total roof: $20,000

- Insurance: $8,500

- You pay: $11,500

Scenario B: Replacement cost coverage (common two-step payout)

Many replacement cost claims pay in two stages:

- Initial payment (often ACV first, minus deductible)

- Holdback (the depreciation amount) after you complete repairs and submit invoices

Using the same numbers:

- Step 1 (initial): ACV $10,000 − $1,500 = $8,500

- Step 2 (after replacement): depreciation holdback = $10,000

- Total insurance: $18,500

- You pay: $1,500 (deductible)

Same roof. Same storm. Massive difference.

4) “Recoverable depreciation” (the term that changes everything)

When you hear: “We’ll release the rest after you replace it,” that’s usually recoverable depreciation.

- The insurer calculates depreciation

- They may hold it back

- You receive it only after you repair/replace and provide proof (receipts/invoices), and only within the policy’s rules/time limits

If you can’t front the money to start repairs, this can be stressful — even with replacement cost coverage.

Ask: “Is depreciation recoverable on this claim? What do you need from me to recover it?”

5. Pros and Cons: Actual Cash Value vs Replacement Cost Home Insurance

You’re not “wrong” for choosing one or the other — but you should know the trade-offs.

Pros of Actual Cash Value (ACV)

- Lower premiums

ACV coverage usually costs less than replacement cost, especially for older homes or older belongings. Insurers and agents often note that ACV policies are cheaper but leave you with more out-of-pocket after a loss. - May be standard on older roofs or certain risks

Some insurers only offer ACV on older roofs or in high-risk weather areas. - Can be okay if you could self-fund the gap

If you have strong savings and are comfortable paying some of the replacement cost yourself, ACV might be an acceptable trade-off.

Cons of Actual Cash Value

- Bigger out-of-pocket at claim time

Because depreciation is subtracted, you might not get enough to fully repair or replace your home or belongings. NAIC and CFPB both warn that ACV coverage often doesn’t fully cover the cost to restore your home. - More risk of being underinsured

If building costs spike (labor, materials), your ACV payment may feel especially small compared to what it actually costs to fix things now. - Can slow or complicate rebuilding

You may have to make tough choices: smaller repairs, cheaper materials, or delaying work because you don’t have enough money to match the depreciation.

Pros of Replacement Cost

- Pays what it actually costs to rebuild/replace (up to limits)

Replacement cost coverage is designed to cover today’s cost to repair or replace, without depreciation, for similar quality and materials. - Better protection against inflation and rising construction costs

As materials and labor get more expensive, replacement cost coverage helps you stay closer to “made whole” after a loss. - Simpler emotionally during a disaster

You’re not arguing about how old the couch was or whether the roof had “too much wear”; you’re focused on getting your home functioning again.

Cons of Replacement Cost

- Higher premiums

Most guides and insurers agree: replacement cost coverage generally costs more than ACV. - Conditions & rules (like the 80% rule)

Many policies require you to insure your home to at least a certain percentage (often 80% or more) of its replacement cost to fully benefit from replacement cost coverage. If you’re underinsured, you might get only a partial payout. - Two-step payouts

You may only get ACV up front and need to complete repairs before receiving the “holdback” (the rest of the replacement cost), which can be stressful if you don’t have cash or credit to start the work.

6. Hybrid Reality: Many Policies Mix Both

Real-world policies often use replacement cost for the structure and ACV for contents, unless you pay extra to upgrade contents to replacement cost.

Common combinations:

- Dwelling: Replacement cost

- Roof: Sometimes replacement cost, sometimes ACV (depends on age and insurer)

- Personal property (contents): ACV by default, with option to add replacement cost endorsement

Government and consumer resources also note that some types of insurance (like standard flood policies) may pay structure at replacement cost if certain conditions are met, but contents at ACV.

So when you think about actual cash value vs replacement cost home insurance, don’t just ask “Which do I have?”

Ask:

- What’s the settlement basis for my dwelling?

- What about my roof?

- What about my personal property?

They might not all be the same.

7. How to Decide Which Coverage Is Right for You

Here’s a simple decision lens.

Step 1: Could you afford to “self-insure” depreciation?

Ask yourself:

If a major covered loss happened tomorrow, could I comfortably cover the depreciation gap out of pocket?

If the honest answer is “no”, then heavy reliance on ACV coverage could be risky.

Step 2: How old is your home and major systems?

Older elements (roof, wiring, plumbing, HVAC) have more depreciation applied under ACV. That means:

- ACV on older properties can produce significantly lower payouts

- Replacement cost becomes especially valuable for older homes that would otherwise be heavily discounted

State insurance departments and NAIC repeatedly emphasize checking whether your home is insured on ACV or replacement cost and understanding how age and depreciation will affect any claim.

Step 3: Are you already underinsured?

For replacement cost coverage to fully work, you usually need to carry enough coverage to meet the percentage requirement (often around 80% of the home’s replacement cost). If you cut your dwelling limit too low to save on premiums, you could trigger penalties even under a replacement cost policy.

It’s worth asking your agent:

- “What do you estimate my home’s full replacement cost is?”

- “Am I insured to at least 80–100% of that?”

- “What happens if I’m not?”

Step 4: Review your budget vs risk tolerance

- If money is tight right now, ACV coverage might look attractive because it lowers premiums.

- But you’re trading lower monthly cost for potentially huge out-of-pocket costs after a disaster.

For many homeowners, a good middle ground is:

- Dwelling on replacement cost, carefully set to realistic replacement cost numbers

- Strong emergency savings (or access to credit)

- Optional replacement cost for contents, if they couldn’t easily replace belongings themselves

8. Quick FAQ: Actual Cash Value vs Replacement Cost Home Insurance

Q1: Is replacement cost always better than actual cash value?

It usually offers better protection after a loss because it doesn’t subtract depreciation, but it also costs more and may require higher coverage limits. “Better” depends on your budget and whether you could afford to cover the depreciation gap yourself.

Q2: How do I know which one I have right now?

Check your policy declarations page and the “loss settlement” section. Look for phrases like “settled at actual cash value” or “settled at replacement cost.” If it’s not clear, call your agent and specifically ask:

“Is my dwelling insured on actual cash value or replacement cost? What about my personal property?”

Q3: Can I switch from ACV to replacement cost?

Often yes, but it might require underwriting approval and will almost always change your premium. You may also need to increase your coverage limit to a more accurate replacement cost level.

Q4: Does market value matter for this?

Not really. Regulators and insurers stress that replacement cost is not the same as market value. Market value includes land and local real estate trends. Replacement cost is about what it costs to rebuild the structure, not what you could sell it for.

Q5: Why did my neighbor get more money than I did for a similar claim?

Common reasons include:

- They had replacement cost; you had ACV

- Their coverage limit was closer to true replacement cost

- Their policy or state law treated depreciation differently (for example, whether labor can be depreciated)

Final Thoughts

If you remember nothing else from this guide, remember this:

“Actual cash value vs replacement cost home insurance” is really about whether your insurer pays based on what things were worth as used, or what it costs to actually rebuild and replace them today.

Before the next storm, fire, or freak accident, take 10–15 minutes to:

- Read your declarations page

- Ask your agent how your claims would be settled

- Check if your limits match a realistic replacement cost

- Decide whether ACV is a risk you’re comfortable taking, or if it’s time to move more of your coverage to replacement cost