Last updated: December 05, 2025

Written by Balotellio_Writer, Home Insurance & Money Basics Educator

You open your homeowners policy and see this:

- Deductible: $1,000

- Wind/Hail Deductible: 2%

And your brain goes: “Wait… 2% of what? And which one applies when?”

The phrase “wind and hail deductible vs deductible” is really about understanding two different buckets of out-of-pocket costs:

- Your standard (all other perils) deductible – usually a flat dollar amount

- A separate wind and hail deductible – often a higher percentage of your home’s insured value

In storm-prone states, this difference can mean paying $1,000 out of pocket… or $8,000–$15,000+ for the exact same roof claim. Experian+2Facebook+2

Let’s break it all down in clear, beginner-friendly language, with real numbers.

1. Quick Refresher: What Is a Deductible, Anyway?

A deductible is the amount of money you pay out of pocket on a covered claim before the insurance company pays the rest. The Insurance Information Institute describes deductibles as the part of the loss you’re responsible for, and a way of sharing risk between you and the insurer. Experian

Example with a standard deductible:

- You have a $1,000 deductible

- A covered kitchen fire causes $12,000 of damage

- Insurance pays: $12,000 – $1,000 = $11,000

- You pay: $1,000

That simple dollar-amount deductible is usually your “all other perils” deductible. It generally applies to things like:

- Fire

- Theft

- Water damage from a burst pipe

- Vandalism

…except when the policy carves out special rules for certain risks like wind, hail, or hurricanes.

2. What Is a Wind and Hail Deductible?

A wind and hail deductible is a separate, special deductible that only applies to damage caused by wind or hail (and sometimes specific storm types like named storms or hurricanes).

Key points that consumer and industry guides agree on:

- It is separate from your standard deductible

- It is often higher than your standard deductible

- It can be a flat dollar amount or, very commonly, a percentage of your dwelling coverage (Coverage A) Experian+2Facebook+2

- It kicks in only for wind or hail losses (or only for certain storms, depending on wording) Citi+1

Typical ranges seen in homeowners markets:

- Percentage wind/hail deductibles often range from about 1% to 5% of the home’s insured value, and sometimes more in high-risk areas. Experian+4Facebook+4Lending Stream+4

So when you see:

“Wind/Hail Deductible: 2%”

…it usually means:

You pay 2% of your Coverage A limit out of pocket on wind or hail claims, before insurance pays the rest.

3. Wind and Hail Deductible vs Standard Deductible: Core Differences

Let’s compare wind and hail deductible vs deductible (your standard one) side by side.

a) Trigger

- Standard deductible (all other perils)

- Applies to most covered causes of loss: fire, theft, certain water damage, etc.

- Wind and hail deductible

- Applies only when the damage is caused by wind or hail, or sometimes only by certain storms (e.g., named storms or hurricanes) depending on policy language. Experian+2Experian+2

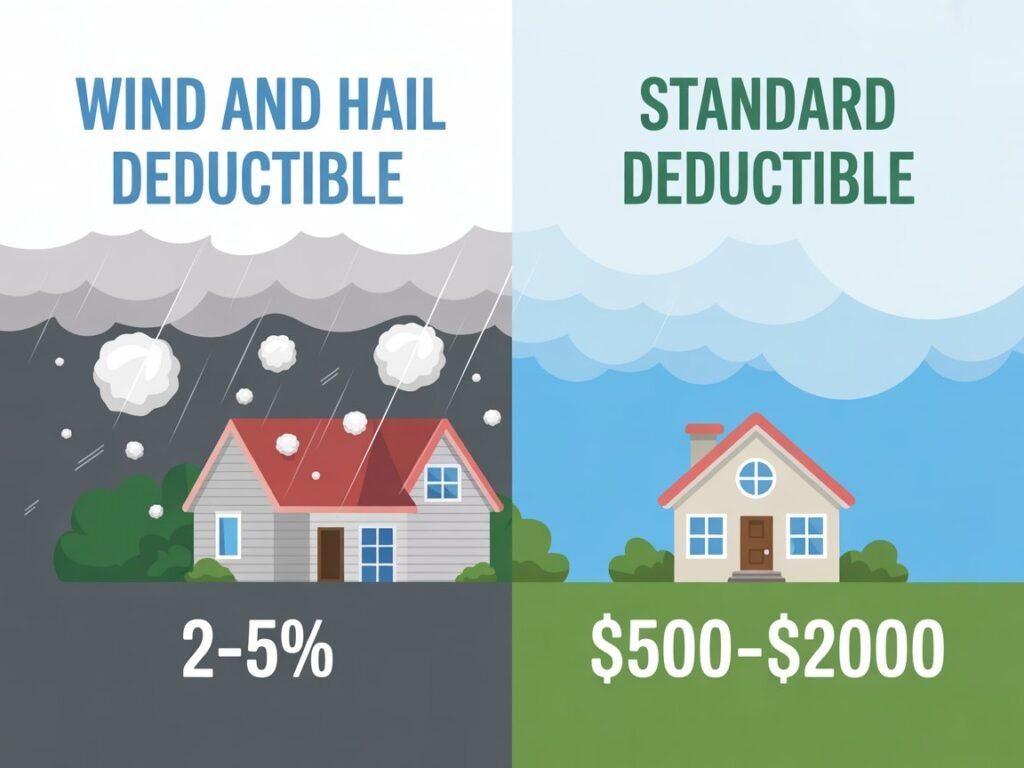

b) Amount Style

- Standard deductible

- Usually a flat dollar amount ($500, $1,000, $2,500, etc.) Experian+1

- Wind and hail deductible

- Often a percentage of your Coverage A (dwelling limit) – commonly 1–5%, sometimes up to 10% in extreme risk areas FDIC Ask+4Experian+4Facebook+4

- Can also be a flat dollar amount in some policies (eg. “$2,500 wind/hail deductible”) UK Debt Expert+1

c) Typical Size

- Standard deductible: often in the $500–$2,500 range

- Wind/hail deductible: could be $2,000–$10,000+, depending on your home value and the percentage chosen. Investopedia+6Intuit Credit Karma+6Experian+6

d) Why insurers use them

Insurers introduced higher percentage-based deductibles for catastrophic perils (wind, hail, named storms) to keep coverage available in high-risk regions and to share more of the cost of large weather events with policyholders. Investopedia+3Compare the Market+3Lending Stream+3

4. Real Number Example: Standard Deductible vs 2% Wind/Hail

Say your policy shows:

- Coverage A (Dwelling): $400,000

- Standard deductible (all other perils): $1,000

- Wind/Hail deductible: 2% of Coverage A

Now a hailstorm destroys sections of your roof. Repairs will cost $12,000.

Because this is hail damage, the wind and hail deductible applies, not your $1,000 standard deductible.

- Calculate your wind/hail deductible:

- 2% of $400,000 = $8,000

- Apply to the claim:

- Loss: $12,000

- Deductible: $8,000

- Insurance pays: $4,000

- You pay: $8,000 out of pocket

If the exact same $12,000 roof damage had happened from, say, a falling tree with no windstorm (and your policy treated that as a non-wind peril), your regular $1,000 deductible might have applied instead, and insurance would have paid $11,000.

This is why the wind and hail deductible vs deductible difference can feel brutal if you only notice it after a big storm.

5. Another Example: 1% Hail Deductible vs Flat Deductible

Some policies use a smaller percentage or a flat hail deductible.

Example from a major insurer:

- Dwelling coverage: $200,000

- Hail deductible: 1% (hail only)

That means:

- Hail deductible = 1% × $200,000 = $2,000

- If a hailstorm causes $5,000 in roof damage, the insurer might pay $3,000 and you pay $2,000. UK Debt Expert+1

In contrast, a policy with a $500 flat hail deductible on that same $5,000 claim would only require $500 out of pocket before coverage kicks in. HSBC UK

So it’s not just “Do I have a wind/hail deductible?”

It’s:

- Is it flat or percentage-based?

- What percentage?

- Does it apply to all wind and hail or only certain storms, or only roof claims? Facebook+1

6. Special Cases: Named Storm and Hurricane Deductibles

Some coastal and hurricane-prone states don’t just have generic wind/hail deductibles; they have named storm or hurricane deductibles that kick in only when specific conditions are met. FDIC Ask+3Experian+3Experian+3

Key traits:

- Usually percentage-based (1–10% of insured value)

- Triggered only by a named storm or hurricane as defined in the policy or state law

- May apply once per season for hurricanes in some states (e.g., Florida) Experian+2Experian+2

Example:

- House insured for $300,000

- 5% named storm deductible → homeowner pays $15,000 on hurricane damage before insurance kicks in Experian+1

These are functionally similar to wind/hail deductibles but even more narrowly focused and often higher, and they’re a big reason hurricane claims can be expensive out of pocket even with insurance.

7. Why Are Wind and Hail Deductibles So High Now?

In many parts of the US, especially hail-prone and wind-prone states (Texas, Colorado, parts of the Midwest and Plains, coastal regions), insurers have:

- Raised wind and hail deductibles

- Shifted from flat deductibles to percentage-based

- Implemented separate catastrophic (CAT) deductibles for convective storms, hurricanes, and similar events Investopedia+3Facebook+3Compare the Market+3

Recent reporting notes, for example, that in parts of Texas:

- Hail/wind deductibles that used to be 1% have commonly moved to 2% of the home’s value, meaning a $500,000 home might now have a $10,000 wind/hail deductible. Investopedia+1

Why this shift? Main reasons:

- Severe wind and hail events have become more frequent and costly

- Roof claims have skyrocketed in certain regions

- Insurers use higher, peril-specific deductibles to keep premiums somewhat manageable and reduce their exposure to widespread storm losses Investopedia+3Lending Stream+3Compare the Market+3

The trade-off: lower premium now, but a much higher out-of-pocket when a storm hits.

8. Pros and Cons of a High Wind/Hail Deductible

When you compare wind and hail deductible vs deductible, you’re really choosing your risk balance.

Potential benefits of a higher wind/hail deductible

- Lower premiums

- Higher percentage or dollar deductibles often mean lower annual premiums, especially in storm-heavy regions. Lending Stream+1

- Can make it possible to get coverage at all in high-risk areas (insurers may refuse to write low deductibles for wind/hail there).

Risks and downsides

- Big out-of-pocket hit when a storm actually hits

- A 2–5% deductible on a $400,000 home is $8,000–$20,000 you must pay before insurance chips in. Experian+2Facebook+2

- Many claims end up below the deductible, meaning you get no payout even though you have damage. Rising deductibles are one reason a growing share of storm claims end with no payment. Investopedia

- Can delay or prevent repairs if you don’t have savings or access to affordable credit.

So a higher wind/hail deductible might be okay if:

- You have solid emergency savings

- You understand the risk and are comfortable self-insuring part of storm losses

But it can be dangerous if:

- You’re already stretched thin

- A surprise $8,000–$15,000 bill would wreck your finances

9. How to Check Your Own Wind and Hail Deductible vs Deductible

Here’s a quick step-by-step to decode your policy.

- Find the deductible section on your declarations page

- Look for entries like:

- “All Other Perils Deductible” or “AOP Deductible”

- “Wind/Hail Deductible”

- “Hurricane Deductible” or “Named Storm Deductible” reddit.com+2Experian+2

- Look for entries like:

- Note the type and amount

- Is your wind/hail deductible:

- A flat dollar amount? ($2,500, $5,000, etc.)

- A percentage? (1%, 2%, 5% of Coverage A)

- Write down both the standard deductible and the wind/hail deductible.

- Is your wind/hail deductible:

- Convert any percentage into real dollars

- Example: Coverage A = $350,000; wind/hail deductible 2%

- 0.02 × $350,000 = $7,000

- That’s the amount you’d pay on wind or hail claims. Experian+3Intuit Credit Karma+3Experian+3

- Ask your agent specific questions

- “Does this wind and hail deductible apply to all wind/hail events or only named storms?”

- “Does it apply to roof claims only or any wind/hail damage?” Facebook+1

- “Can I choose a lower wind/hail deductible, and how would that change my premium?”

- “If a hurricane hits, is that a different deductible than the wind/hail one?”

- Compare your deductible to your savings

- If your wind/hail deductible is $8,000 but you only have $1,000 in emergency savings, that’s a red flag.

- You may want to adjust your coverage or start a dedicated “storm deductible fund.”

10. Quick FAQ: Wind and Hail Deductible vs Deductible

Q1: If I have both, which deductible applies – wind and hail deductible vs deductible?

If the damage is caused by wind or hail (as defined in your policy), the wind/hail deductible usually applies instead of the standard deductible. For other covered perils (fire, theft, burst pipes), the standard deductible applies. Citi+2Facebook+2

Q2: Can I have a separate hail deductible that’s different from my wind deductible?

Yes. Some policies have separate deductibles for different perils: a standard deductible, a hail-only deductible, and a hurricane or named storm deductible. It all depends on your insurer and state. Experian+3UK Debt Expert+3HSBC UK+3

Q3: Why are percentage wind/hail deductibles more common in some states?

In hail-heavy and hurricane-prone regions, percentage deductibles (1–5%+ of the dwelling limit) help insurers manage catastrophic losses and keep policies available, but they shift more upfront cost to homeowners after storms.

Q4: Can I change my wind/hail deductible right before a storm?

Insurers typically put moratoriums in place when a storm is approaching or has been named, meaning you can’t buy new coverage or change deductibles until the event passes. It’s important to review and set deductibles before hurricane or storm season, not the day a storm is on the news.

Q5: Is it ever smart to choose a very high wind/hail deductible?

It can make sense if you:

- Have strong savings

- Want to lower premiums

- Treat the high deductible as a form of self-insurance for moderate storm damage

But for many people, extremely high percentage deductibles are risky because they can’t realistically cover $10,000–$20,000 out of pocket after a major storm.