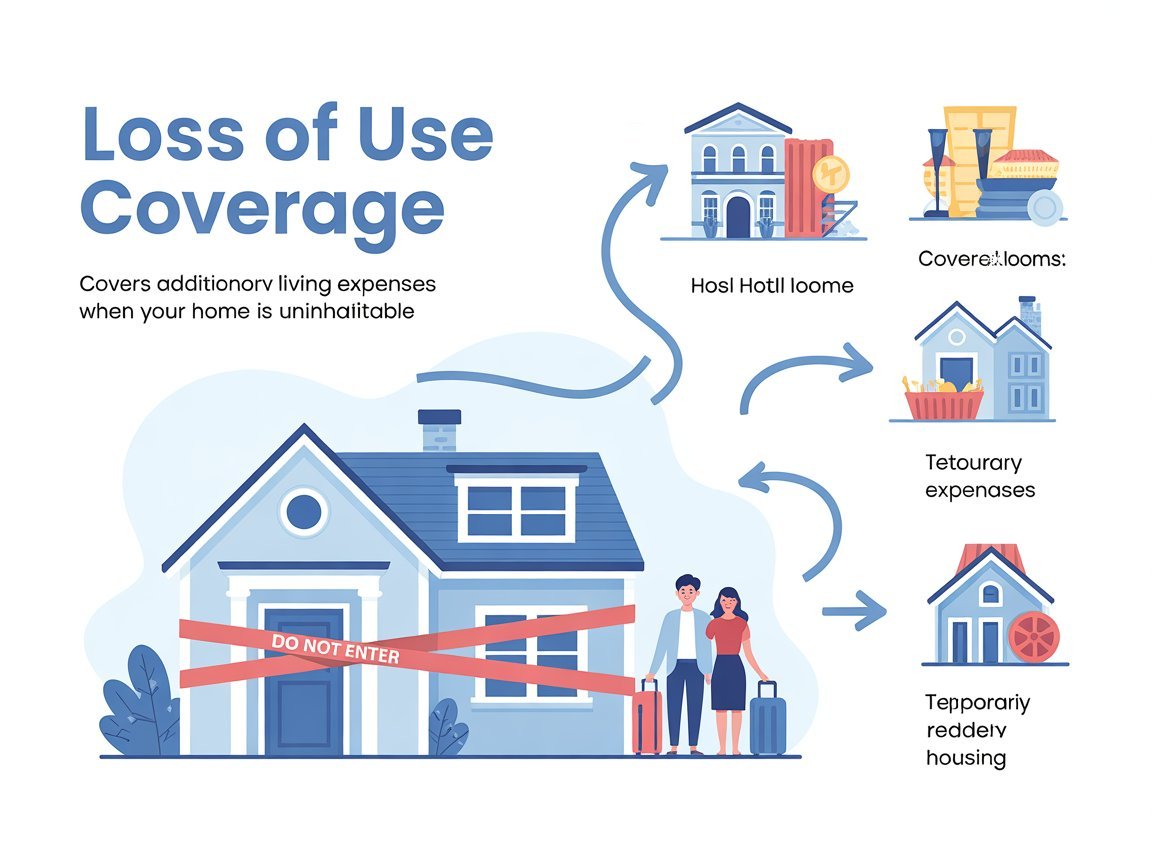

Loss of Use—often called Additional Living Expense (ALE) or Coverage D—reimburses the

extra costs of living elsewhere when a covered loss makes your home temporarily unlivable.1

Key takeaways

- ALE pays the difference between what you normally spend and what you must spend while displaced (it’s not “all expenses”).1

- Mortgage isn’t reimbursed, and many policies don’t reimburse normal utilities at your primary residence—ALE targets extra costs caused by displacement.1 2

- Limits vary: some policies use a dollar cap, some time cap, or both; many set Coverage D as a % of Coverage A—but the % differs by insurer and form.

- Receipts matter: keep bills and receipts—insurers commonly require them for reimbursement.1 2

1) When Loss of Use (ALE) applies

Most claims come down to three requirements:

- Covered cause of loss: the damage must be from something your policy covers.3

- Home is unlivable/uninhabitable: you can’t safely live there while repairs happen.1

- You have extra costs because you had to leave: ALE is designed for expenses you wouldn’t have had if you could stay home.1

Important: If the loss isn’t covered (example: flood damage without flood insurance), loss of use typically won’t apply.3

Some state guidance also calls out that if the event isn’t a covered peril under your policy (such as flood/earthquake in many standard policies), ALE coverage won’t apply.2

2) What it typically pays for

Common ALE categories (subject to reasonableness and your limit):

- Temporary housing: hotel, short-term rental, apartment.

- Meals above normal spending (especially if you can’t cook).

- Laundry, pet boarding, storage, extra transportation (common examples listed in consumer guidance and insurer explanations).2 3

- Setup/relocation costs can be eligible in some scenarios (for example: relocation/storage, furniture rental, or utility/phone installation at a temporary residence), depending on policy and situation.7

3) What it usually does NOT pay

Loss of Use is about extra costs—so “normal bills you’d pay anyway” are typically not reimbursed:

- Your mortgage: you still owe it even if you’re displaced.

- Regular utilities at your primary residence (many policies/guides treat these as non-reimbursable “normal” bills).2 3

- Non-covered peril displacement (example: earthquake/flood displacement under a policy that excludes those perils).2 3

4) The rule that controls most payouts: “normal vs extra”

Consumer guidance is consistent: your policy does not pay all living expenses—it generally pays the

difference between your normal living expenses and your temporary expenses.1

Simple formula

Reimbursable ALE = temporary costs − normal costs

Example (clean math)

Normal monthly spending

- Housing (mortgage): $1,600

- Groceries: $700

- Commute: $150

Temporary monthly spending

- Short-term rental: $2,800

- Food (more eating out): $1,100

- Commute (farther away): $220

Extra amounts (potential ALE)

- Housing: $2,800 − $1,600 = $1,200

- Food: $1,100 − $700 = $400

- Commute: $220 − $150 = $70

Total potential ALE for the month: $1,670 (subject to reasonableness and your policy limits).1 3

5) How you get paid: reimbursement vs direct billing

Two common approaches (varies by insurer and claim size):

- Reimbursement: you pay first, then submit receipts. Receipts are commonly required.12

- Direct billing / advances: sometimes used in larger losses—ask what’s available and what budget they consider reasonable.

Day-one question to ask

Do I pay and get reimbursed, or can you place me directly in housing? What nightly/monthly budget should I stay under?

6) Limits: how much coverage you have (and how long it lasts)

Some policies have a dollar limit, some have a time limit, and some have both—separate from the money used to repair your home or replace your belongings.12

Many insurers express Loss of Use as a percentage of Coverage A (Dwelling), but the default percentage varies by company and form.5

Travelers describes a common range of about 20%–30% of the dwelling limit in many policies.3

Progressive notes that some home policies may be set at 10% or 20% of the dwelling coverage limit.6

Coverage commonly stops at the earliest of:

- your home is habitable again,

- you permanently relocate, or

- you hit the policy’s dollar/time limit.1

7) Renters and landlords: quick clarity

- Renters: renters insurance commonly includes ALE and generally reimburses the difference between additional and normal living expenses (up to the policy limits).4

- Landlords / rental income: some policies include “fair rental value” under Loss of Use (policy-specific). Travelers describes paying fair rental value for rental income you’re missing out on when the rental becomes unlivable due to a covered loss.3

8) Common mistakes that reduce payouts

- No baseline: not tracking “normal” spend (harder to calculate the difference).1

- Missing receipts: slows or prevents reimbursement.12

- Unreasonable housing choice: renting far above what’s reasonable for household size/needs can get capped or negotiated.

- Non-covered peril displacement: assuming flood/earthquake displacement is covered under a standard HO policy when it isn’t.23

9) The simplest ALE tracker (Notes or Sheets)

Track each item like this:

- Date + category

- Amount

- Why it’s extra (one sentence)

- Receipt photo (snap it immediately)

Also save:

- a screenshot of your last 2–3 months of groceries (baseline), and

- the adjuster’s written budget guidance (email/text).

10) Questions to ask your insurer (copy/paste)

What is my Loss of Use / ALE limit (dollar amount and/or percentage of Coverage A)?

Is there a time limit separate from the dollar limit?

Do you reimburse me, or can you direct-bill housing / provide an advance?

What do you consider “uninhabitable” under my policy?

Do you cover pet boarding, storage, and extra transportation—what documentation do you need?

11) California-only note (wildfire / declared emergency)

California has consumer guidance and statutory timeframes that don’t apply nationwide.

The California Department of Insurance explains ALE can cover additional costs when a property is not safe to live in due to a covered peril (like wildfire),

and describes timeframes (including minimum periods and extensions) in declared emergencies, subject to policy dollar limits.7

- Time limit guidance: CA DOI describes 36 months plus six-month extensions for good cause, and also explains a minimum 24 months after a state of emergency plus an extension up to 36 months when reconstruction delays are beyond the policyholder’s control (policy dollar limits can still run out).7

- CA DOI also reiterates that some policies may exhaust the dollar limit before these timeframes end—so you must check your declarations and forms.7

FAQ

Does Loss of Use pay my mortgage?

Usually no. Consumer guidance and insurer explanations say ALE covers extra expenses and you remain responsible for your mortgage.123

How much Loss of Use do people usually have?

Often a percentage of Coverage A, but the default varies widely by insurer and policy form.

Travelers cites a common range of about 20%–30%, while other insurers may use 10% or 20% depending on the policy.36

Do I need receipts?

Yes—consumer guidance commonly stresses keeping receipts and bills for reimbursement.12

References

- NAIC. “What are Additional Living Expenses and How Can Insurance Help?”

Source

↩ - Oregon Division of Financial Regulation. “Additional living expenses (ALE) – frequently asked questions” (PDF).

Source

↩ - Travelers. “What is Loss of Use Coverage for Home Insurance?”

Source

↩ - Insurance Information Institute (III). “Renters Insurance” (ALE generally reimburses the difference between additional and normal living expenses).

Source

↩ - NAIC. “A Consumer’s Guide to Home Insurance” (policy package limits often expressed as % of dwelling limit) (PDF).

Source

↩ - Progressive. “Loss of Use Coverage for Homeowners & Renters” (example limits like 10% or 20% of dwelling coverage).

Source

↩ - California Department of Insurance. “Insurance coverage for additional living expenses if the home is not habitable due to a wildfire” (time limits and example eligible categories).

Source

↩ - California Department of Insurance. “Commissioner Lara orders insurance companies…” (press release reiterating ALE timeframes in declared emergencies).

Source

↩

Disclosure: Educational only. Coverage, limits, deductibles, and definitions (like “uninhabitable”) vary by insurer, state, and policy form. Always verify your declarations page and endorsement wording.