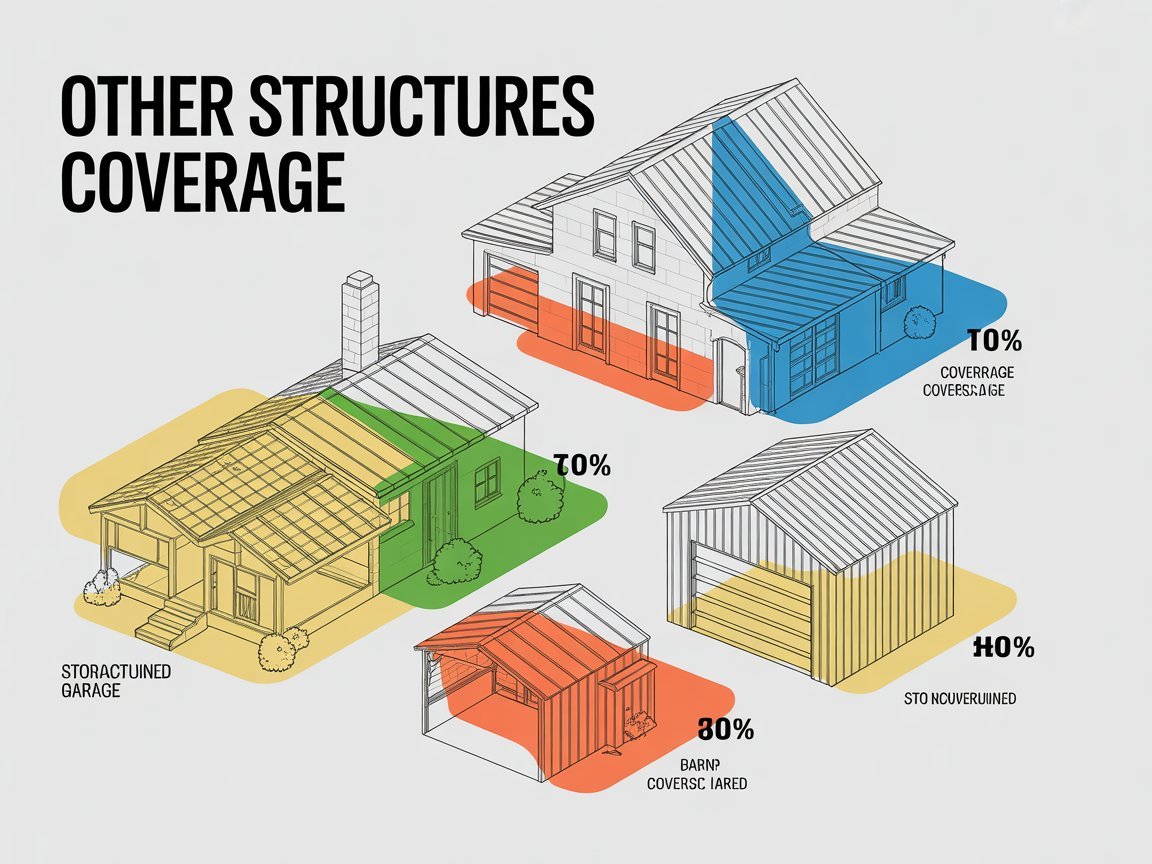

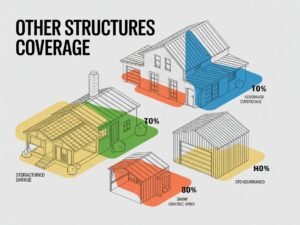

Other structures coverage (Coverage B) generally covers structures on your property that aren’t attached to your house—commonly fences, sheds, and detached garages.1 2

Many policies set Coverage B to about 10% of your dwelling limit (Coverage A) by default, but the amount can vary and is often adjustable.3

- Coverage B = detached structures (not attached to the main house).1

- Default is often ~10% of Coverage A, but you can usually raise it if you have high-value detached structures.3 5

- The building and what’s inside are different “buckets”: the shed/garage may be Coverage B, while tools/bikes inside are typically Coverage C.1

- Solar can land in A or B depending on how it’s installed (roof-mounted vs ground-mounted)—confirm classification in writing.8

1) What “Other Structures” (Coverage B) actually covers

Think of your property coverage as three buckets:

- Coverage A (Dwelling): the house and usually attached structures

- Coverage B (Other Structures): structures not attached to the house

- Coverage C (Personal Property): the stuff inside (tools, bikes, furniture, electronics, etc.)

Insurance references commonly describe Coverage B as protecting detached structures such as garages, sheds, and fences.7

Common Coverage B examples

Often included (varies by policy):

- Fences and gates1

- Detached garage / detached carport4

- Sheds / workshops / small outbuildings2

- Gazebos / pergolas4

Reality check: Some items (for example, pools or driveways) may be treated differently depending on your insurer and policy form.

Some insurance references list these as examples of “other structures,” but you should confirm how your insurer classifies them and whether any special limits apply.8

2) How much Coverage B do you get?

Many policies default Coverage B to around 10% of Coverage A. NAIC’s consumer guide shows a “typical” package structure where

Other Structures = 10% of the dwelling limit.9

The Insurance Information Institute likewise notes detached structures are generally covered for about 10% of the dwelling amount.10

Major insurers and consumer resources commonly describe the same pattern (“typically 10%,” but adjustable).1

Example:

- Coverage A: $400,000

- Coverage B (10% default): $40,000

That $40,000 is the maximum Coverage B can pay (before your deductible) for covered damage to all other structures combined in a single event,

unless your policy states otherwise.1 4

When the 10% default is often not enough

- Large detached garage/workshop (finished space, upgraded construction)

- Long or high-end fencing (vinyl privacy, masonry, long perimeter)

- Multiple outbuildings (shed + greenhouse + pergola + fence adds up)

- Ground-mounted or detached-structure solar (see Section 4)

Travelers notes most policies cover other structures for about 10% and suggests considering an increase based on what you have on the property.1 5

3) Fences, sheds, and detached garages: common “gotchas”

Fence claims: deductible math matters

Fences are commonly treated as other structures, but small-to-medium fence claims can be uneconomical once you factor in your deductible.

If the repair cost is close to the deductible, the insurer may pay little or nothing even if the damage is covered.1 6

Detached garage or shed: building vs. contents

- The structure itself = typically Coverage B

- Stuff inside (tools, bikes, lawn equipment) = typically Coverage C, with its own limits and rules

This mismatch is common: your shed may be insured under Coverage B, but the expensive tools inside are limited by Coverage C (and sometimes sub-limits).1

4) Solar panels: where they fit (Coverage A vs Coverage B)

Solar is a common place people get underinsured because the same equipment can land under different buckets depending on installation.

Progressive notes homeowners insurance may cover solar panels under either dwelling or other structures, and specifically says

ground-mounted solar panels may be covered under other structures coverage (Coverage B).8

Do this before you assume you’re covered: Ask your insurer to confirm in writing:

- Are my solar panels treated as Coverage A or Coverage B?

- Do I need to increase Coverage B (or add an endorsement) to match replacement cost?

- If panels are leased, who insures them (homeowner vs leasing company)?8

5) What causes of loss are covered?

Coverage B typically follows the same overall “covered perils” structure as the rest of the property section (policy-form dependent),

but exclusions and limits vary by insurer and form.

The Insurance Information Institute notes standard homeowners policies cover disasters listed in the policy and commonly exclude flood and earthquake (often requiring separate coverage).1 9

NAIC also notes flood and earthquake are commonly excluded from standard homeowners insurance and may require separate policies/endorsements.2

If you only do one thing: skim exclusions for:

- Flood / earth movement (often excluded)

- Wear-and-tear / maintenance (not a covered “accident”)

- Water backup / sump overflow (often needs an endorsement)

6) Business use and rentals: the biggest Coverage B surprise

Homeowners policies can limit or exclude coverage for business property and may have restrictions when a structure is used for business purposes.

III notes a typical homeowners policy may provide only limited coverage for business equipment, which is often not enough for home-based businesses.2

IRMI also discusses that homeowners forms can restrict coverage for other structures used in business (policy wording matters).2

If any of these apply, tell your insurer before a loss:

- Paid shop/workspace in a detached garage

- Business inventory stored in a shed

- Detached structure rented to others

7) 10-minute sizing check (do this once)

Step 1: Pull your declarations page

Write down:

- Coverage A (Dwelling)

- Coverage B (Other Structures)

- Your deductible(s)

Step 2: List detached structures and estimate replacement cost

Use “rebuild today” cost (not what you paid years ago):

- Fence: $_____

- Shed/workshop: $_____

- Detached garage: $_____

- Pergola/gazebo/greenhouse: $_____

- Ground-mount / detached-structure solar: $_____

- Other: $_____

Step 3: Compare totals

If your total replacement cost is close to or above Coverage B, price:

- Increasing Coverage B, and/or

- Adding an endorsement/scheduled coverage for a specific structure or solar system

This aligns with how consumer guidance and major insurers describe Coverage B as a common starting point that may need to be increased based on your detached structures.2 4

8) Questions to ask your insurer (copy/paste)

- “Is my Coverage B set to a default percentage or a custom amount?”2

- “What exactly counts as ‘other structures’ on my policy (fences, pool, driveway, retaining walls)?”8

- “How are my solar panels classified—Coverage A or Coverage B?”8

- “Do any of my detached structures have business/rental restrictions I should know about?”9

- “What would it cost per year to increase Coverage B?”

FAQ

Does Coverage B cover what’s inside my shed or detached garage?

Usually the building is Coverage B, while contents are typically Coverage C (personal property) with separate limits and rules.1

Is Coverage B always 10%?

Often, but not always. NAIC shows 10% as a typical package default, and insurers note it can vary and may be increased.3 2

Are fences covered?

Fences are commonly listed as “other structures,” but whether a claim pays depends on the covered peril, your deductible, and the Coverage B limit.4

Are solar panels covered?

Often, but classification can differ. Some policies may treat ground-mounted systems under other structures coverage, while roof-mounted systems may fall under dwelling coverage. Confirm classification and limits with your insurer in writing.8

References

- NAIC. A Consumer’s Guide to Home Insurance (typical package limits table; Coverage B often 10% of Coverage A; exclusions vary).

Source (PDF)

↩ - NAIC. “Homeowners Insurance” (coverage categories; Other Structures examples like fences and sheds).

Source

↩ - Insurance Information Institute (III). “What is covered by a standard homeowners policy?” (detached structures generally ~10%; flood/earthquake commonly excluded).

Source

↩ - Travelers. “How Much Homeowners Insurance Do I Need?” (other structures generally ~10% and may need to increase).

Source

↩ - Progressive. “What Is Other Structures Coverage?” (Coverage B typically set at 10% of Coverage A; examples; adjustability).

Source

↩ - IRMI. “Other structures” (definition and common examples; often 10% of dwelling limit; examples may differ by policy).

Source

↩ - Allstate. “Dwelling Insurance” (other structures limit typically a percentage, such as 10%).

Source - Progressive. “Does Home Insurance Cover Solar Panels?” (ground-mounted panels may be covered under other structures; leased panels often handled differently).

Source

↩ - Insurance Information Institute (III). “Insuring Your Home-based Business” (typical homeowners coverage limits for business equipment; need to confirm options).

Source

↩ - IRMI. “Insuring the Home-Based Business—Part 2” (discussion of homeowners form business restrictions affecting other structures; policy wording matters).

Source

↩

Disclosure: Educational only. Coverage, exclusions, and limits vary by insurer, state, and policy form.

Always confirm your policy wording and declarations page.